Explore Commercial Truck Protection Plans

Why Do You Need a Protection Plan From Premier Financing?

- Today’s commercial vehicles are high-tech marvels of engineering that deliver unparalleled fuel economy and reliability. However, with technical sophistication also comes vehicle components that can be costly to replace should they fail.

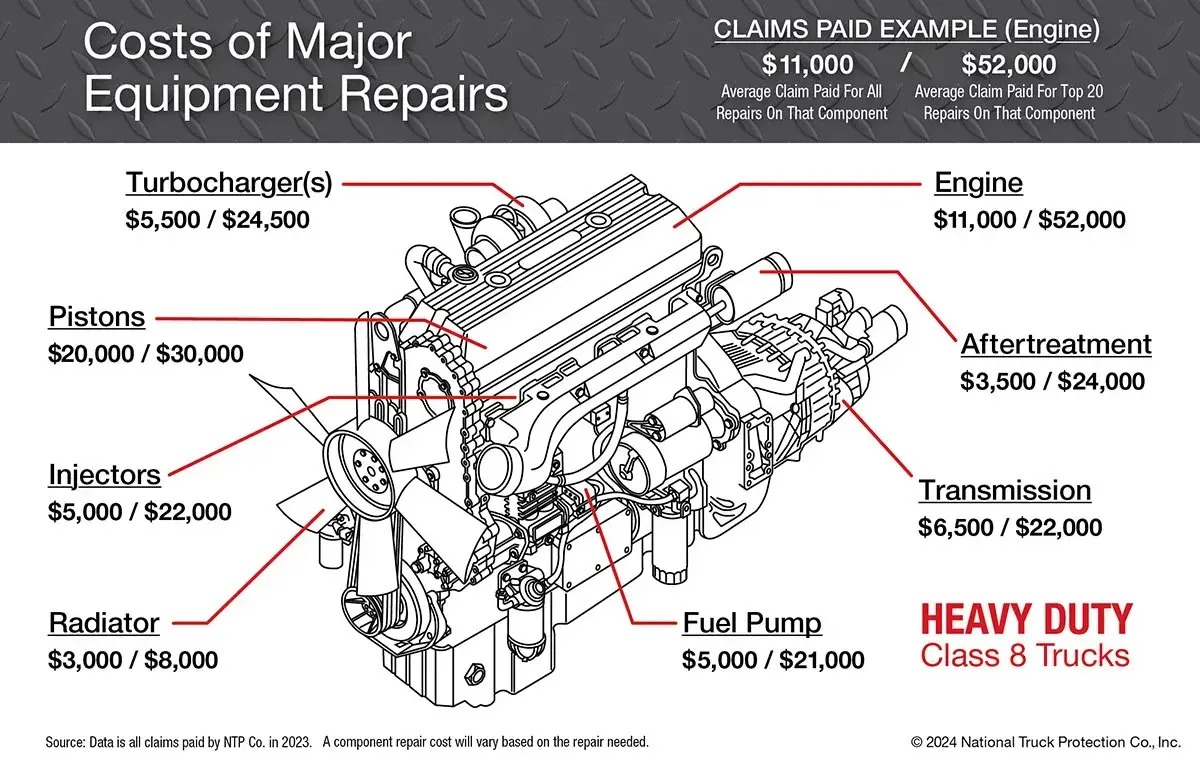

- Premier Financing extended coverage plans cover a wide range of components including engines, transmissions, injectors, turbochargers, aftertreatment systems and much more.

- Components could cost up to 100% more than a similar component did less than 10 years ago.

- Premier Financing extended coverage plans are available from 12 months/100,000 miles to 48 months/400,000 miles for most purchases.

- Comprehensive extended coverage plans from Premier Financing are critical to assuring that you maintain the cash flow needed to run your business and the peace of mind to focus on achieving your transportation goals.

GAP

GAP Protection Program

Protect Your Truck and Your Wallet

Did you know that if your vehicle is stolen or declared a total loss, you may still be responsible for paying off a portion of the vehicle finance contract?

Many people owe more on their finance contract than their insurance company will pay in the event of total loss. GAP is an amendment to a vehicle finance contract that waives a portion or all of what you owe on the finance contract after an insurance settlement is paid for the total loss of a vehicle. GAP will also pay for your insurance deductible (where permitted by state).

Always be Prepared

You may think it won’t happen to you, but the theft or total loss of a vehicle can take you by surprise. The surprise can be twice as unpleasant if your primary insurance carrier’s settlement is less than the amount needed to pay off your finance contract’s outstanding balance.

Major Components Repair Costs Range

The high cost to repair one major equipment failure could put your business in jeopardy. A Premium 2000+ Protection Plans will protect your business, your investment and your livelihood.

Sonsio Tire & Wheel Program Details:

Coverage is not insurance or rotection plan of any kind and is not transferable or refundable

$600 maximum limit per claim

Unlimited claims for length of contract

NO MAXIMUM tire replacements during the coverage term

Claims must be replacement related and incurred over the road. Damage incurred at the home base or where the unit is stored is not considered roadside or over the road and is therefore NOT covered

Tires with tread measuring less than 3/32” are NOT covered

Tire replacement service must be performed by a licensed provider

You must purchase the replacement tire. You will be reimbursed for the replacement once all required documentation has been submitted and approved

The reasonable cost of mounting, demounting, valve stems and disposal for any tire replaced and/or wheel repaired or replaced due to a covered road hazard is included.

Accident / Maintenance / Adjustments / Hazmat Clean-up / Vandalism / Weather / Acts of God or similarly related claims are NOT covered

NO COVERAGE for any service not specifically listed above.

Frequently Asked Questions

Why should I buy a Protection Plan?

While we would like trucks to last forever, we know that all vehicles will eventually need parts and service repairs. Protecting your investment and ensuring steady business operations is one of your most important decisions along with purchasing a truck. Our coverages allow you to focus on operations and profitability, not on paying for a large, unexpected repair bill.

What is the difference between the Protection Plans coverages and providers?

Each provider we work with is trusted in the industry and has a strong relationship with Premier Financing. Depending on the make, model, age, and mileage of your vehicle, coverages and availability varies, so our Protection Plans experts make sure to match the coverage that best meets the needs of your vehicle and your business model.

What is Roadway Advantage Platinum?

Roadway Advantage is our partner company who provides you with reimbursement for roadside events, such as towing, road service, and lodging accommodations. The Roadway Advantage Platinum coverage allows you to submit qualifying bills, up to 5 claims per year of up to $1,500 per claim. Towing and roadside labor costs can be expensive, so purchasing a coverage package protects you from unexpected bills. And you get your money fast! Most claims are paid within 24-48 hours of receipt.

Do I need GAP/GAPlus waiver coverage?

GAP/GAPlus is extremely important in maintaining the operations of your business in the event of a total loss. Even putting money down, insurance may not pay you what you think you deserve for your vehicle. And if you owe more on your loan than you receive, GAP/GAPlus coverage will cover the difference, leaving cash in your bank account to operate your business. And with GAPlus, you will receive up to 10% (or $10,000) toward the down payment of a replacement truck through one of our dealerships.

What is Roadway Advantage Platinum?

Roadway Advantage is our partner company who provides you with reimbursement for roadside events, such as towing, road service, and lodging accommodations. The Roadway Advantage Platinum coverage allows you to submit qualifying bills, up to 5 claims per year of up to $1,500 per claim. Towing and roadside labor costs can be expensive, so purchasing a coverage package protects you from unexpected bills. And you get your money fast! Most claims are paid within 24-48 hours of receipt.